Environmental, Social, and Governance (ESG) factors have evolved from peripheral considerations to central pillars in corporate strategy. Companies worldwide increasingly understand that sustainable practices are ethical imperatives and critical to long-term growth and investor confidence. Nowhere is this more evident than in the energy sector, where the shift toward renewables is central to ESG objectives.

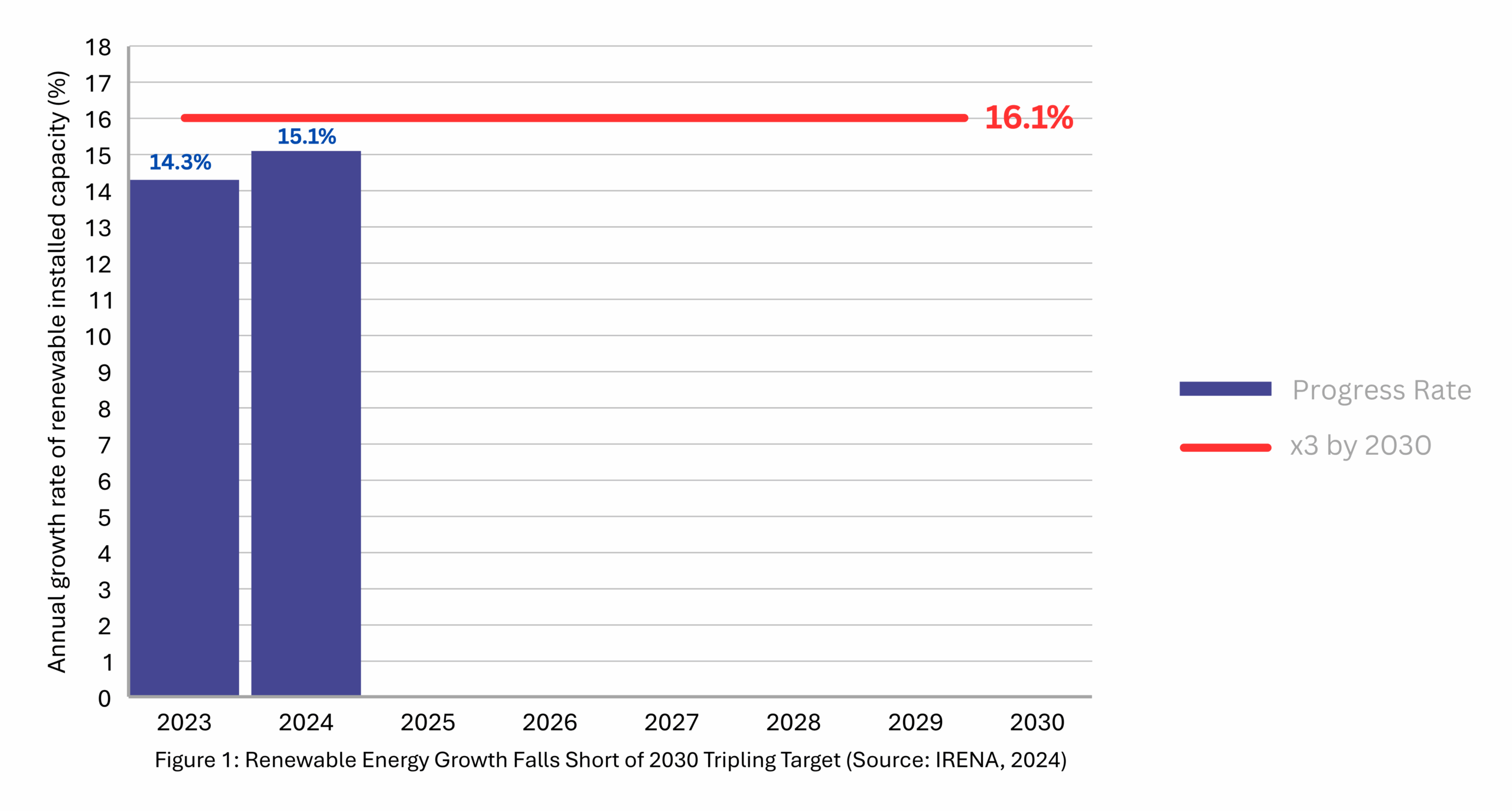

Yet, even with a record 15.1% growth in global renewable energy capacity in 2024, the world remains behind on its goal to triple installed capacity by 2030. According to the International Renewable Energy Agency (IRENA), reaching that target now requires a sustained annual growth rate of 16.6%. This shortfall highlights the urgent need for more ambitious national targets and actionable insights that only strong market research can deliver. By uncovering adoption barriers, mapping opportunity areas, and guiding policy direction, market research helps bridge the gap between climate ambition and implementation.

Corporate Energy Transitions: The ESG Push in Action

Leading corporations are setting ambitious targets to transition toward renewable energy, showcasing ESG commitments that go beyond policy statements:

These initiatives reflect a growing global momentum: more than 400 multinational companies have joined the RE100 initiative, publicly committing to sourcing 100% of their electricity from renewable sources. This collective effort signals a decisive shift in corporate energy strategies, driven by environmental responsibility and long-term competitiveness.

According to the IEA’s World Energy Investment 2024 report, global energy investment exceeded $3 trillion by 2024, underscoring a decisive global shift toward sustainability. Of this total, $2 trillion was earmarked for clean energy technologies, which reflected an accelerated move away from fossil fuel dependency.

Solar photovoltaic (PV) technology is leading this transformation, with anticipated investments reaching $500 billion, making it the most heavily funded electricity generation technology worldwide. China remains the dominant player in the clean energy space, with estimated investments of $675 billion, followed by Europe ($370 billion) and the United States ($315 billion). These figures reveal a deepening global commitment to decarbonization and energy transition.

The Imperative Role of Market Research in the ESG Shifts

According to S&P Global Commodity Insights (2025), cleantech investments are projected to reach $670 billion, outpacing fossil fuels for the first time. This surge underscores how clean energy technologies are rapidly advancing to cut emissions and confront climate change.

Here’s how market research supports ESG alignment:

- Stakeholder Alignment: Understanding the evolving expectations of investors, customers, and regulators is essential. Market research provides actionable insights to ensure ESG initiatives resonate with stakeholder priorities and values.

- Technology Adoption: As green technologies evolve, market research helps identify and validate the most effective solutions tailored to specific operational needs and industry dynamics.

- Risk Mitigation: Market research enables businesses to proactively manage ESG-related risks and avoid reputational pitfalls by monitoring emerging trends, competitive positioning, and regulatory shifts.

- Strategic Planning: Robust, data-driven insights empower organizations to define measurable ESG goals, build realistic implementation roadmaps, and track their sustainability performance over time.

Without comprehensive market intelligence, companies risk misallocating resources, adopting misaligned strategies, or falling behind in a rapidly evolving ESG environment.

How ActionEdge Supports the Renewable Transition

Building on the global trends and ESG imperatives, ActionEdge empowers organizations to make informed, confident decisions on their renewable energy journey through targeted, data-driven research solutions:

- ESG Sentiment Analysis: Monitoring perceptions across industries to evaluate the real impact of sustainability initiatives.

- Targeted Surveys: Engaging energy leaders, CFOs, and sustainability officers to gather insights on market trends and operational challenges.

- Supply Chain Mapping: Assessing supplier readiness and identifying risks related to renewable energy adoption.

- Benchmarking Studies: Delivering comparative analyses that inform strategic planning and investment priorities.

Conclusion: Where ESG Meets Action

ESG is no longer optional – it’s essential for resilience and growth. As renewable energy adoption accelerates, organizations must ground their strategies in solid insights that align with stakeholder expectations and operational realities.

The renewable revolution is more than emissions reduction; it’s about future-proofing your business, building trust, and maintaining competitive advantage. With regulatory pressures increasing, your next steps demand insight, agility, and evidence-backed strategies – not just good intentions.

Are your sustainability decisions truly aligned with what your stakeholder’s value? Do you have the right data to confidently guide your energy transition?

At ActionEdge, we turn complex market realities into clear, actionable insights. From tracking ESG sentiment to mapping leadership perspectives, we help you connect the dots and act with purpose.

Share your insights and experiences with us-together, let’s harness data-driven strategies to accelerate sustainable growth.